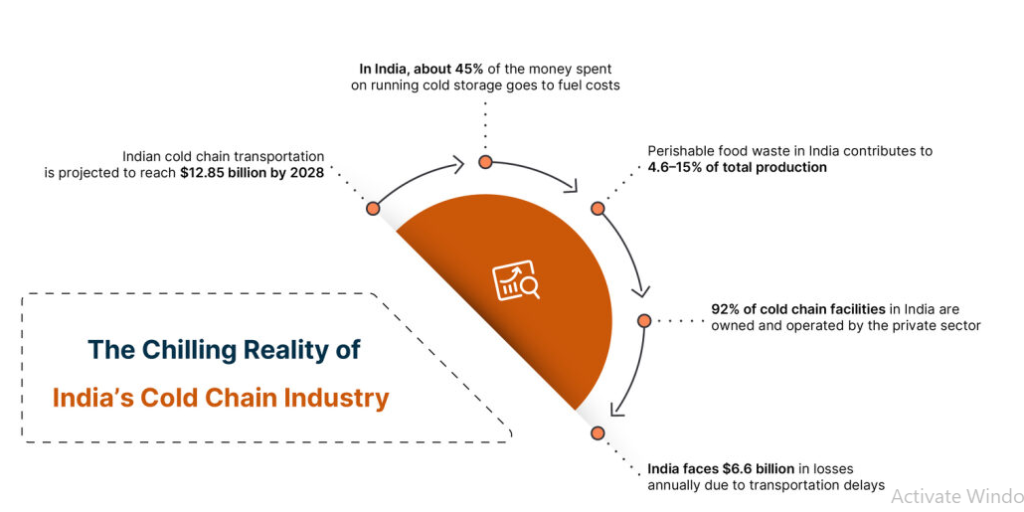

The rising demand for perishable goods is a major growth factor for the Indian cold chain logistics sector. Due to this, the Indian cold chain transportation market is projected to expand from $9.75 billion in 2023 to $12.85 billion by 2028 at a CAGR of 5.67% according to a Mordor Intelligence report.

India is a major player in terms of perishable goods production, be it food products to pharmaceutical goods. India is on course to be the world’s fifth-largest economy by 2027, states a Mordor Intelligence report. Being a significant global player, there’s an anticipated annual increase in investments towards enhancing India’s supply chain infrastructure.

Adding to that, the cold chain industry in India is relatively young, which makes it a highly promising sector within cold chain warehousing and logistics. However, there are many factors contributing to challenges in Indian cold chain logistics. We will explore some of the challenges and suggest ways how businesses can overcome them.

Addressing Current Challenges in Indian Cold Chain Logistics

India has its own set of challenges when it comes to cold chain logistics. The major contributing factors are because of the difficult geographical topology, unawareness of technological advancements, and extreme climatic conditions. Let’s explore these challenges in more detail and see how they affect the cool chain landscape.

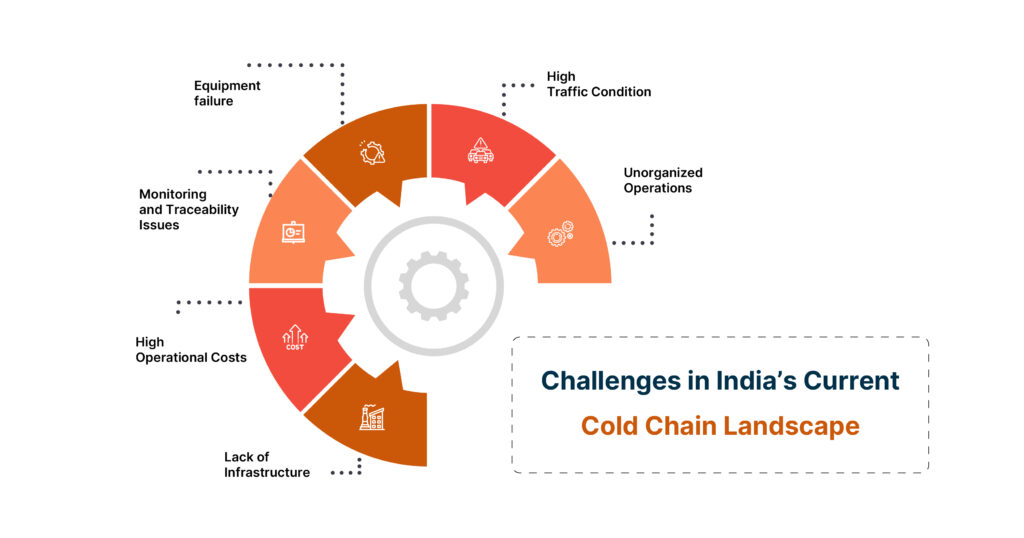

Lack of Mobile Infrastructure

We need to create important moving units like freezer trucks, freezer containers, reefer vans/trucks, carriers, and merchandising carts. Due to the scarcity of mobile cold chain equipment, the Indian cold logistics sector is unable to satisfy the demand. Though the equipment and vehicles can make the cost of transportation go up, still in the long run it is beneficial for the businesses.

High Operational Costs

According to an AWL India article, in India, about 45% of the money spent on running cold storage goes to fuel costs, making the overall expenses much higher. Indian cold storage companies typically pay around Rs 100 or more per cubic foot each month for their operations. This is twice as much as what it costs in the West, where fuel expenses are only 10% of their total costs. So, high operational costs is another reason holding back the Indian cool chain transportation.

Monitoring and Traceability Issues

Insufficient emphasis on monitoring reefer parameters in vehicles leads to spoilage and deviations in the cold chain transport, affecting trade. According to MOFPI, in India, perishable food waste contributes to 4.6–15% of total production. Similarly, according to NCCD, there’s currently no motivation to enhance operational controls in cold chain transport. Encouraging cold chain tracking and monitoring systems could address challenges in Indian cold chain logistics.

Equipment failure

Power outages or electricity fluctuations can disrupt powered cooling systems. Issues like coolant failures and poor cooling circulation can affect cold chain management, increasing maintenance costs. This can result in significant wastage as perishable goods are exposed to heat for an extended period, compromising product quality and profitability.

Unorganized Operations

The cold chain industry in India is largely unorganized, a MOFPI report states that 92% of cold chain facilities in India are owned and operated by the private sector. This industry is highly scattered and absent in many states. Surprisingly, only four states—UP, Gujarat, West Bengal, and Punjab facilitate 60% of the country’s cold storages, highlighting the fragmented nature of the sector.

People also read- Quit Manual Processes: Achieve 20% Higher Efficiency with Logistics Process Automation

High Traffic Conditions

Especially in India, the traffic is a major reason behind delayed deliveries. In cold chain transportation delays can potentially result in spoilage of products even if they’re in a temperature-controlled environment. According to Live Mint article, India faces $6.6 billion in losses annually due to transportation delays.

FleetRobo for Challenges in Indian Cold Chain Logistics

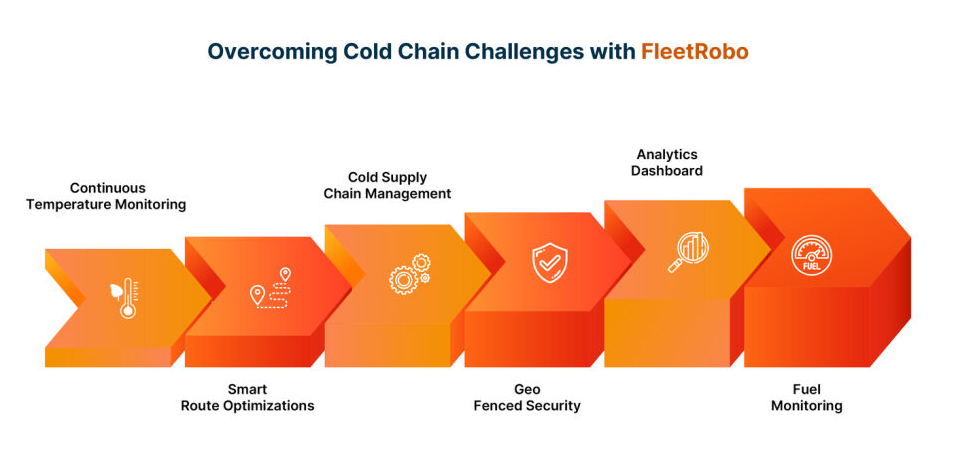

FleetRobo cold chain monitoring system comes as an effective solution to overcome unique challenges in the Indian cold chain logistics sector.

Continuous Temperature Tracking

FleetRobo cold chain monitor can track up to four reefer chambers at the same time, each with different temperature settings. Its IoT Devices and temperature sensors provide live data on temperature fluctuations along with humidity levels.

Smart Route Optimizations

The smart route optimization aids cold chain logistics providers by going beyond traditional route planning. It not only creates efficient and cost-effective paths but also strategically plans delivery destinations to align with receivers’ preferences and convenience. This feature ensures real-time adjustments based on the route, eliminating delays and loss. Contributing to enhanced customer satisfaction through timely and tailored deliveries.

Supply Chain Management

FleetRobo’s cold chain logistics solution facilitates the smooth coordination and control of various types of deliveries within a cold transportation supply chain. Businesses can efficiently transport goods between central hubs in the supply chain and optimize dispatch from central hubs to warehouses. Moreover, it also allows coordinated deliveries to various supply chain locations for timely product arrival at each designated point.

Geo Fenced Security

FleetRobo allows you to create virtual boundaries with its geofence feature. So, for cold chain logistics operations, businesses can create designated areas within which a fleet should remain. In case the reefer container violates the boundary, FleetRobo generates instant alerts and notifies the fleet manager.

Analytics Dashboard

With FleetRobo’s smart dashboard, businesses can track the performance of their reefer trucks. With this feature, you get detailed reports of fuel consumption, traveled distance, mileage, and other minute details. With these analytical reports, businesses can easily cut down extra operational costs in their cold chain logistics processes.

Growing Trends in Indian Cold Chain Logistics

Growing Demand for Fresh Products

The shift towards healthier diets is driving an increased demand for specialty and fresh products. According to PIB, in 2022-2023, India exported 674,291.70 MT of fresh fruits to the world. As consumer demand continues to rise, it becomes necessary for cold chain companies in India to uphold the freshness standards of these products.

Surge in Processed Foods Demand: Government Initiatives in Focus

The upward trend in consumer demand for processed foods has prompted the Indian government to establish multiple Mega Food Parks across the country. This strategic move is expected to catalyze the growth of cold supply chain companies in India, facilitating the efficient handling and distribution of processed food items.

Growing Healthcare Sector Demand

The healthcare sector is experiencing a surge in demand for temperature-sensitive products, such as vaccines, biopharmaceuticals, and clinical trial materials. With these markets poised for double-digit growth, there is a heightened need for reliable cold chain logistics companies in India to ensure the optimal storage conditions for these critical healthcare products.

Conclusion

So, FleetRobo stands as a crucial solution for the challenges in Indian cold chain logistics. With features like continuous temperature tracking, smart route optimization, and geo-fenced security, it ensures efficiency and control throughout the cool chain transport. The analytics dashboard provides valuable insights for cost reduction. Given the rising trends in the cold chain sector, particularly the growing demand for fresh, processed foods, and healthcare products, FleetRobo not only meets the current needs but positions businesses for future success. So, connect with our team of experts and explore streamlined and effective cold chain logistics operations in the dynamic Indian market.

Also Read: Empower Logistics for Sustainable Growth with Fuel Monitoring